Having financial confidence at home is important for making purchasing and investment decisions with peace in mind. Unfortunately, many educational systems lack financial education, leaving us to navigate this crucial area on our own. This article draws on the wisdom of my parents, friends, and online resources I’ve found over the years to empower you on your financial journey.

The first step is to understand your current financial position and how it will evolve over time. This analysis makes it easy to then decide how much to save, invest or take on debt1. This process has personally equipped me to make strategic choices, particularly during two major life events:

1. study abroad

My dad helped me build my first projection for the 12 months of a masters program abroad. This exercise uncovered what should be the limit in different areas of spending, like dining out, in order to stay on budget and finish the program without financial stress.

2. marriage

It was important for us to go through a financial analysis together to gain a common understanding of our spending habits and also to get clear alignment on a plan to save for future goals like travel and home ownership.

By looking at my income and spending behaviours, I can assess how much I’ll be able to afford the activities I would like to do over the next months. A basic spreadsheet is a powerful tool to get started. Here’s a step-by-step guide:

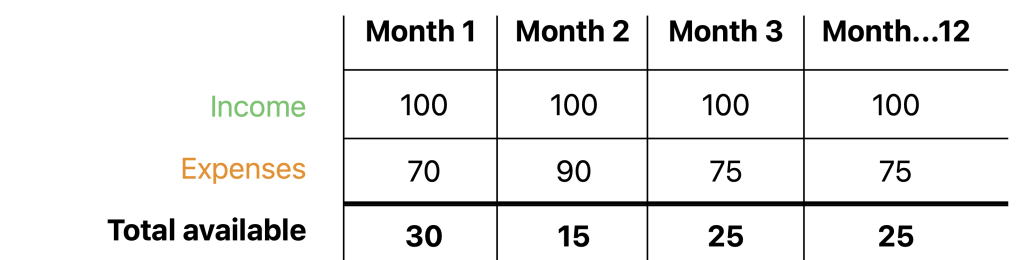

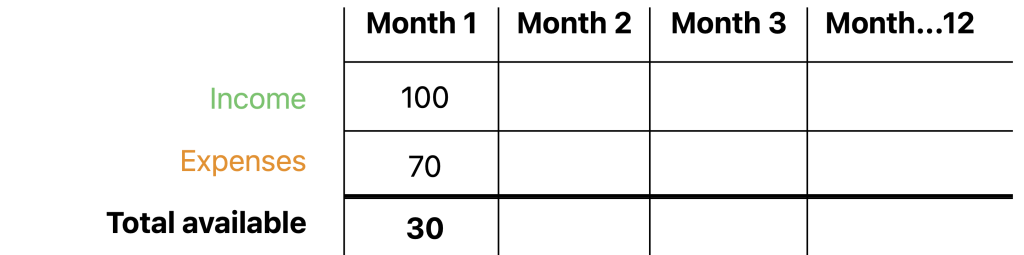

- Structure your spreadsheet: Rows represent income and expense categories, while columns track the values for the next 12 months.

- List your income sources: such as salary, pension, or side hustles.

- Categorize expenses: Dedicate the following rows to expenses including electricity bills, taxes, rent, groceries, entertainment, etc.

- Calculate your monthly surplus: In the final row, use a formula to automatically subtract total expenses from total income, revealing your available spending money for each month. This provides a clear picture of your financial breathing room.

While gathering your expense list might take some time upfront, the payoff is having a clear understanding of your spending habits. Fortunately, many resources can simplify this process:

- Online Banking and Credit Card Tools: These platforms often categorize your past transactions, providing a valuable head start.

- Expense Tracking Apps: Explore apps like Spendee, PocketSmith, or YNAB. These tools allow you to manually enter daily expenses or connect seamlessly to your online banking for automatic tracking.

Once you have your first month’s expenses, simply copy them into subsequent months, adjusting for variations. For instance, include less frequent expenses like a family vacation or a car purchase in order to have a holistic view.

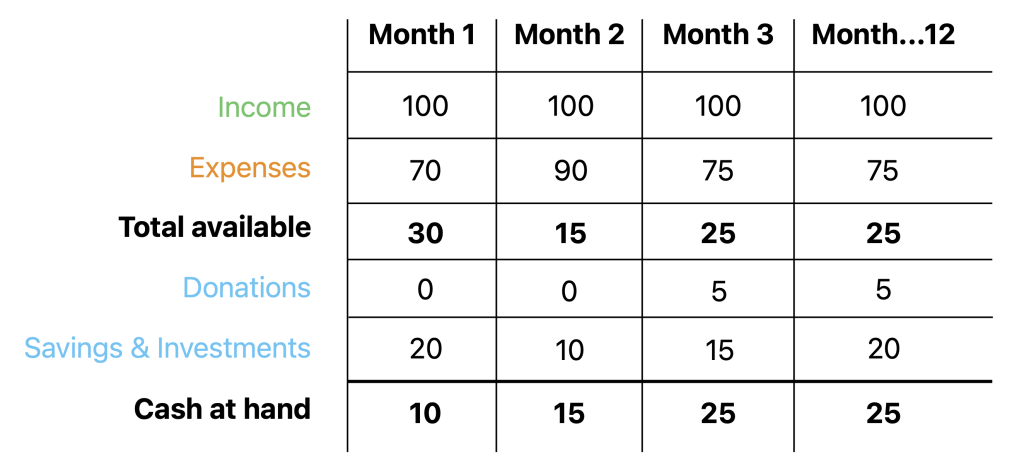

Now the next step is where financial planning gets exciting and is meant for you to allocate funds towards long-term goals:

- Donations: invest in causes you care about, such as supporting family, protecting the environment, faith-based initiatives, or orphanages around the world.

- Savings: allocate funds towards savings accounts and pension funds.

- Investments: allocate funds on multiple investment vehicles depending on your risk tolerance and goals including company stocks, real estate, gold, or even collectibles like artwork or vintage items.

The remaining unallocated funds become your “cash at hand.” This crucial reserve acts as a financial buffer for unexpected events or emergencies. Carry this amount forward to the next month’s “cash at hand” section to monitor its growth over time. When your cash runs low, it’s wise to prioritize building it back up before making additional investments or donations.

Identify gaps and need for debt

After building the projection, the analysis may show that the income may not cover everything you want to do, like for example a summer internship or a new laptop. This is where debt might be helpful.

However, be aware: taking on debt for non-essential, non-profit-generating items introduces risk to financial well-being. It limits your ability to donate, save, and invest for the future. Debt is best suited for investments that will yield future returns or significantly improve your life, such as:

- educational programs and tools to advance your career

- medical treatments to improve quality of life

- vehicles in areas with limited public transportation options

- real estate

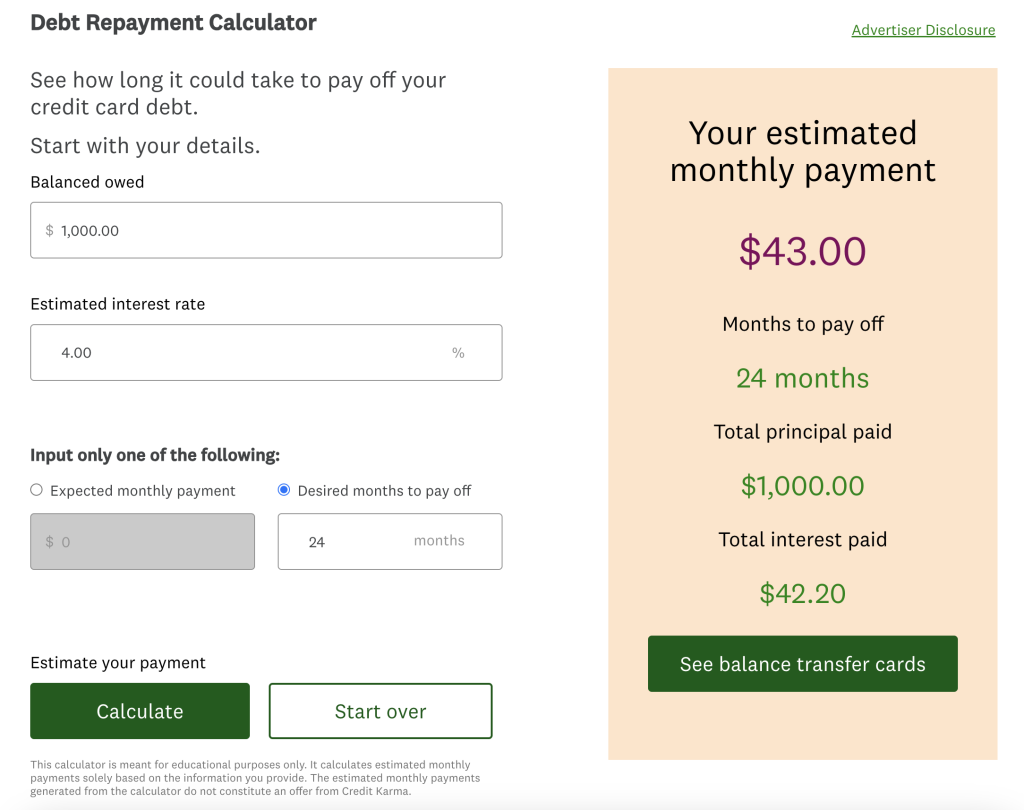

While calculating interest for a loan can be complex, online tools exist to help explore different scenarios with various loan terms and interest rates.

Saving and investing

I witnessed firsthand from my parents work, being real estate agents, how properties increase in value over time despite economic downturns, inflation and political turmoil. This is why owning a home became a financial priority for us after marriage. When we finally purchased our home, I realized that It’s like having a built-in long-term savings account that grows steadily until we decide to sell. The appreciation of the property value functions similarly to interest earned in a traditional savings account.

I believe accumulating wealth solely for the sake of accumulating it is unproductive. Therefore, I regularly reassess my saving and investment goals with my wife. Personal aspirations evolve over time, and revisiting these goals together is a refreshing exercise that strengthens our partnership. The New Year holidays provide a particularly romantic opportunity for these conversations, especially when paired with a pleasant walk or a nice dinner.

Beware of predatory investment schemes and high-risk assets like cryptocurrencies. If an investment relies on others joining and inflating the value of an inherently unproductive asset, be cautious. Personally, I favor investing in companies that are developing cutting-edge technologies like quantum computing, clean energy, and artificial intelligence.

Alternatively, crowdfunding is an emerging investment vehicle to support and co-own companies creating high-impact solutions. Take TropicFeel, for example, a Barcelona-based company, that raised over €1 million from 750 investors through Crowdcube in exchange for a 12% ownership stake. Their goal was to expand their global business of high-quality sneakers made from recycled materials. This strategy proved financially successful, with their revenue growing from €3.3 million in 2019 to €22 million in 2022.

Buy versus rent

We tend to fall into the trap of buying instead of considering smarter alternatives. For instance, owning a car feels liberating and more appealing than relying on public transportation, which essentially functions as a rental system for getting around. Similarly, buying a drill machine to fix furniture to the wall at home can be tempting instead of just renting it.

Here in Madrid, Spain, the well spread public transportation system makes car ownership a less logical choice. Nevertheless, I fell victim to this very temptation with a drill. Convinced I’d use it frequently, I bought one. However, I only used it for the initial month of furnishing my home. Now, it sits collecting dust. Renting the drill, either from a person or a company, would have been a smarter option. This would have minimized waste and provided someone else with valuable income.

The decision between buying and renting extends to our living space. While renting might be enough for short-term needs, homeownership can be a more financially sound option in the long run. Consider this: multiply your monthly rent by 36 months. This gives a better picture of the significant expense renting can become over just three years.

By purchasing a home, these expenses convert into a long term saving that you can get back the day you sell2. This long-term gain makes homeownership appealing, even if it means seeking support from family to cover the initial down payment and fees.

The future

Financial education is an essential skill to manage the economy of home anywhere in the world. Imagine a future where everyone has access to financial education tailored to their specific needs and circumstances. Advancements in artificial intelligence hold immense potential to personalize financial literacy programs, accounting for regional and cultural nuances.

If you found this article valuable, empower others by sharing it with your network. Financial literacy is a shared legacy, and we can collectively build a more secure financial future for ourselves, our families, and our communities.

Have a question or comment? Post it below!

Excelente!!

Llevar un presupuesto familiar detallado es fundamental para que nuestros recursos sean utilizados sabiamente

Totalmente de acuerdo!