Teams around the world are seeing a shift in how they operate by leveraging AI-driven automation. Sales teams use it to refine sales pitches and generate emails quickly, while marketing teams brainstorm advertising ideas and create targeted content in seconds and developers generate code in a heartbeat. This shift allows teams to take a step back and think more strategically about their work, but how do finance teams benefit from AI? While they already use software for tasks like payment collection and payroll, AI-driven automation can offer unique advantages for them. Let’s explore how.

Current state of the art

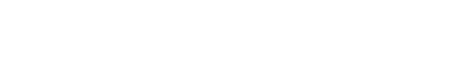

Finance teams rely on Excel spreadsheets and accounting software for planning and reporting by consolidating diverse data from distinct sources. For instance, sales data comes from invoicing and payment systems, payroll details from HR software, and cash operations from banking applications. You can visualize this data flow in the diagram below.

Ensuring data accuracy while also creating and updating budgets and financial forecasts is time-consuming. This is where finance teams need AI most to monitor data flows and process information to generate and update forecasting and modeling scenarios seamlessly. This shift will enable finance teams to oversee many scenarios which would otherwise require a large team to accomplish. The goal is to take a step back and discuss strategically which scenarios would be better suited for the organization, hence improving decision-making.

Up and coming innovation

New AI features and solutions for finance are gradually entering the market, ranging from basic tools like Excel plugins for generating formulas to advanced capabilities like creating entire spreadsheet tables based on prompts with Quadratic AI. However, the ultimate winner in this race will probably be the one that seamlessly integrates AI with end-to-end data flows, eliminating as much tedious work as possible. Microsoft and Salesforce are moving in this direction, aiming for holistic end-to-end systems, though their pace of progress and adoption remains to be seen.

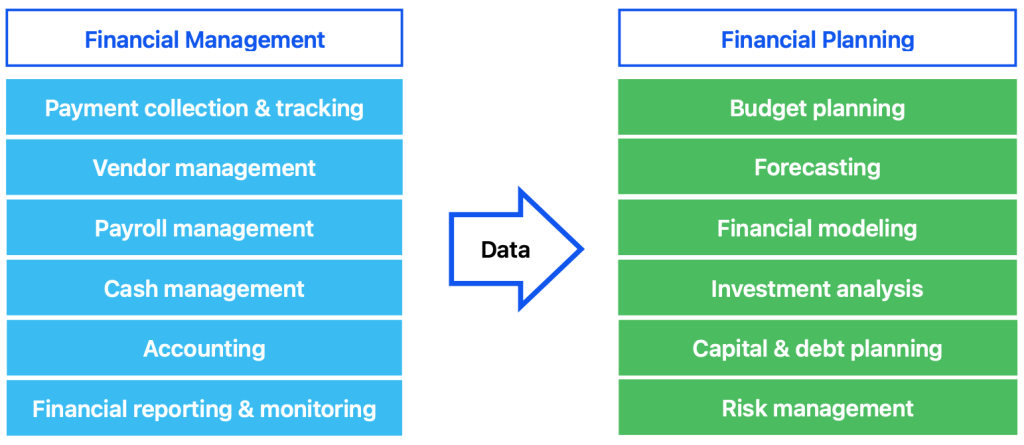

Now, imagine having a specialized AI system streamlining financial planning, a space that’s ripe for entrepreneurs and software companies to disrupt. As shown in the diagram below, data from various teams and software can flow through this AI system, comparing real performance with forecasts, models, budgets, and plans, and suggesting new scenarios and courses of action.

The finance team would interact with this AI system by asking questions to dig deeper, either through voice or text, and provide additional information from the market to refine the AI generated scenarios, especially when tackling unexpected events where funds need to be moved extraordinarily, like for example during a market crash or political instability.

This capability will also extend to investment analysis for mid- to long-term projects. The AI system can recommend utilizing available cash and provide multiple financing options, balancing debt and equity to meet the organization’s investment criteria. Additionally, one of the most critical functions will be identifying cost anomalies, a task that falls under accounting. By continuously monitoring financial data, AI can detect irregularities and discrepancies that might indicate errors, fraud, or inefficiencies, enabling timely corrective actions and enhancing overall financial integrity.

The future finance teams

The augmented finance teams of the future will evolve from spending lots of time crunching numbers to driving strategic initiatives, optimizing investments, and quickly responding to market changes. With AI integrated into financial data flows, teams can ask complex questions, generate multiple future scenarios, and make informed decisions in almost real-time. As software companies develop these AI systems, finance teams that embrace this technology will play a pivotal role in shaping the success of organizations worldwide.

Have a question or comment? Post it below!